Our expert team handling all the accounting and tax matters of many (SMEs) small and medium-sized organizations effectively and proactively. We can take care of your accounting needs and provide efficient tax planning so that business owners can have more time for core business activities. We offer the following professional services.

1. Monthly Management accounts

Your company financial statements carry detailed information about the potential future of your company. Financial transactions of a company can be summarized into monthly management accounts so that directors can take some informed decisions. Smartax can remove the concerns of preparing these reports regularly and give some professional advice based on statistics

2. Employee rights and Employer Compliance

Holiday pay, Maternity, Paternity, Sick leave, Health & Safety Regulations, Rights under Zero-hour contracts, protection from unfair dismissal are few rights of employees covered by the Employment Rights Act 1996. Newly established businesses are generally not aware of such regulations, at Smartax we are equipped with knowledge of related fields and can assist your HR department when required

3. Pension Compliance

Under the Pensions Act 2008, every employer in the UK must put certain staff into a workplace pension scheme and contribute towards it. This is called 'automatic enrolment'. If you employ at least one person you are an employer and you have certain legal duties. In order to avoid penalties from pension regulator and submit legally valid pension declaration our expert team can guide you when required

4. Your turnover & VAT Threshold

Smartax has designed its systems and procedures in a way that can help our clients to take timely and informed decisions. We will inform you when your turnover close enough to reach the level required to register for VAT & VAT schemes available that best suit your business nature.

5. HMRC & Companies House communications

Dealing with the Companies House and the notices issued by HMRC always been an area of great concern for companies. Our professional team is aiding many client organizations when they receive such notices professionally & proactively

6. Records & Book keeping

Companies most often use non-accountant staff for records & Bookkeeping, this led to insufficient filling and important documents often get missing. You can be fined £3,000 by HMRC or disqualified as a company director if you do not keep accounting records. We have experience of different industries and are equipped with knowledge of latest software`s currently dominating industry for Bookkeeping. We can train your existing staff and ensure your team members are fully aware of related compliance

7. Director loans and drawings

Opportunities in a dynamic business environment often required the director to provide a loan to business and often withdraw money from the business. There are set rules & regulations that require Company to pay Corporation Tax @ 32.5% on such loans and interest along with Class one National Insurance implication under certain circumstances. At Smartax, we will advise you, how to declare such loans to HMRC and the best possible way to withdraw money from your company in the form of profits/dividend/salary based on your unique circumstances

8. Personal Car or the company car

Too often our advisor being asked which one is best to do, company car or personal car. There are a number of factors they need to be considered before we can give informed advice, however, the most important factor in decision making is Co2 Emission and Tax relief on business mileage

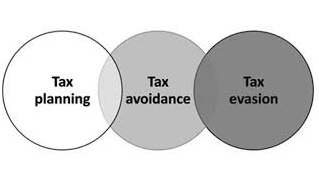

9. Tax Evasion v Tax Avoidance

Sometimes, it is not easy for a company to handle a tough situation which requires in-depth knowledge of accounting and tax standards and you may be penalized by the HMRC by making a false claim or wrong treatment of financial transactions. We can guide you the legitimate ways to minimize your tax by utilizing all possible available allowances

10. Prevent you receiving hefty tax penalties

One of the key things when it comes to finances and working for yourself is keeping on top of the paperwork and avoiding any late penalty fines. For some people, this is part of the job that they are happy to keep up to date with. For others, having an accountant makes sense so they don’t need to worry about looming dates, we are familiar with the latest legislation and ensures that you never miss a tax deadline

11. Domain Registration & Web Hosting

At Smartax we have close links with many high profile web developers and many of them have 20 years of related experience in amazing website development, high-quality Web Hosting and domain registration. Our referred clients get a tremendous discount with 99% satisfaction.

12. Other Services

Other few areas of expertise but not limited to these few

- Retrospective Tax Planning

- Utilization of Tax Breaks

- Business property reliefs

- Rental Income and allowable expenses

- Web & Graphics Designing

- Website Development

- WordPress, Magento, PrestaShop, eCommerce

- Customized Software Development Services

- Search Engine Optimization and Social Marketing